Demystifying Alternative Investments: A Guide to Private Equity and Venture Capital

The quest for lucrative opportunities beyond traditional avenues has led many investors, especially high-net-worth individuals, and business professionals, to explore alternative investments like private equity and venture capital.

Traditional investments – like stocks and bonds – have long been the basis of investment education and have been widely covered in financial literature and mainstream media. Alternative investments, like private equity, venture capital, hedge funds and real estate, receive less attention in the public domain. This makes them appear mysterious or complex to the inexperienced investor.

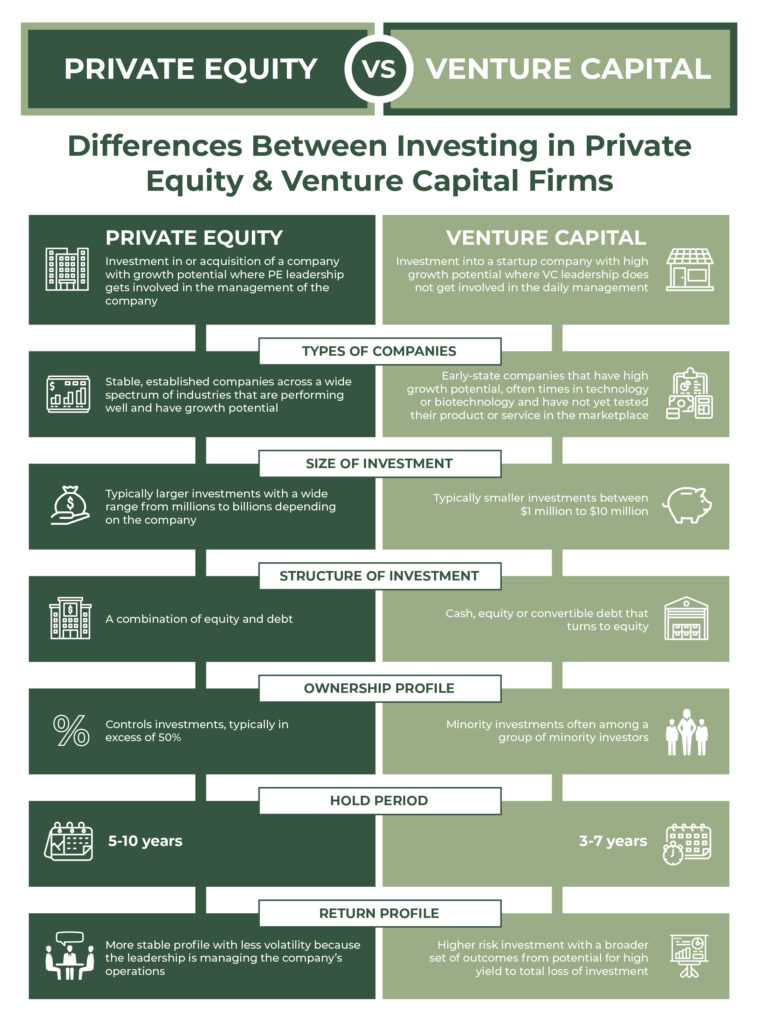

Below I deconstruct the differences between investing in private equity and venture capital – and the opportunities within each.

▾

The Rise of Alternative Investments

By 2025, total alternative investments under management are projected to reach $17.2 trillion (NASDAQ). That’s 4 times the amount since 2010 per NASDAQ. Most of these funds are coming from high-net-worth individuals and institutional investors. In fact, family offices now have more of their money invested in private markets than the public stock market (CNBC).

These investments often have low correlation with traditional assets, providing a hedge against market downturns and inflation. Overall, the adoption of alternative investments among individual investors has been driven by a combination of factors including diversification benefits, higher returns, risk mitigation, exclusive opportunities and tax advantages.

Alternative investments are like a menu for investors. Private equity is a viable option and a stable asset for wealth preservation, whereas venture capital is a dynamic choice for high-risk, high-reward growth. Both are great options, but both are also wildly different. The preference for private equity or venture capital will depend upon the goals and risk tolerance of the investor.

Before investing, it’s important to understand how different asset classes within alternative investments behave across economic cycles. Some assets may perform better during economic downturns, while others thrive in growth phases. Individual investors should follow regulatory changes that might affect alternative investments, such as tax incentives or restrictions on crowdfunding and private placements.

Private Equity as an Investment Vehicle

Think of private equity (PE) as a behind-the-scenes partner of a non-publicly traded company. Instead of buying stocks in the open market, investors pool their money into PE firms. These firms then invest in private companies that aren’t listed on stock exchanges.

Unlike well-known companies you can buy shares of on the stock exchange, these businesses are private—like an undiscovered gem waiting to be unearthed. When you invest in PE, you’re supporting these firms to discover, nurture, and elevate the potential of other companies that are not visible to the public.

When a PE firm invests in a company, it’s not a passive endeavor. Its leadership works closely with the company management to implement strategic changes. This may involve restructuring, cost-cutting, expanding market reach or other initiatives to enhance the portfolio company’s value.

Private equity pioneers like Kohlberg Kravis Roberts & Co. (KKR), Bain Capital and The Blackstone Group proved the viability of the investment model decades ago and set the stage for the thriving industry we know today. KKR was founded in 1975 and made history with its leveraged buyout of Wometco Enterprises in 1984. This landmark deal marked the first billion-dollar buyout transaction. It also demonstrated the legitimacy of the PE model to create value through financial engineering and operational improvements.

Since then, many of America’s most beloved brands have found themselves under private equity ownership. For example, snack brand Hostess®, known for Twinkies® and Ding Dongs®, was acquired by private equity firms Apollo Global Management and Metropoulos & Co in 2013. These firms injected capital and expertise into the struggling brand, revitalizing its market presence and profitability.

Venture Capital as an Investment Vehicle

Investing in venture capital (VC) means investing through a VC firm that funds startups and early-stage companies with high growth potential. These firms identify promising startups in emerging industries that are introducing innovative technologies, products, or services. They look for startups with disruptive ideas, strong teams, and the potential for growth, and infuse capital to empower the existing team with little-to-no management oversight.

VC investments have a relatively higher level of risk compared to PE firms due to the early-stage nature and the uncertainty of startups’ success. This potential risk trickles down to the individual investor who invests through the VC firm as well.

The average hold time for venture capital investments varies from three to seven years. This time allows startups to develop their business models, gain market traction and reach a stage where they can seek additional funding or go public through an IPO.

Unicorns Are Great, But Not Always The Goal

Before going public, Instagram, WhatsApp, and Airbnb were all unicorns, known in VC circles as start-up companies with a private market valuation of at least $1 billion. The firms that invested in these companies as startups believed in the vision and provided the resources needed for them to eventually grow to be the large, profitable, brands we know them as today.

While these high-growth companies capture headlines and investor attention, not every startup will become a unicorn. And that’s ok – that’s not always the goal. VC investment offers opportunities beyond the pursuit of unicorn status and supports startups across industries.

Solyco Capital is an example of a well-established firm that takes a PE approach to early stage growth investing. The portfolio has investments in companies spanning technology, healthcare, biotech, defense, and agriculture sectors. Portfolio companies are identified based on a strong industry advantage, leadership team, market position, growth opportunities, performance and more. Similar to PE firms, Solyco leverages its strategic advisors to support portfolio company strategy, growth, and performance.

Key Differences and Similarities of Private Equity and Venture Capital

Private equity and venture capital are distinctive paths that offer unique opportunities and challenges for individual investors.

1. The Investment Process

Once a PE firm has raised a target amount of capital from individual investors, the firm identifies potential investment opportunities by screening companies to find those with growth potential, operational inefficiencies or untapped markets. Then, the firm performs due diligence through extensive research on the target company’s financial health, market position and growth prospects. If the due diligence phase yields positive results, the private equity firm acquires a significant stake in the target company and gets to work in an advisory capacity.

VC firms operate very similarly to PE firms in their capital raising and due diligence processes. After raising capital, a VC firm scrutinizes every aspect of the business, evaluating its viability and growth prospects. This process is often more challenging than the evaluation of most companies that PE firms look at, as the concept of the business has yet to prove itself in the marketplace. Once the VC firm completes their due diligence, they decide whether to fund the startup. Upon making the investment, the VC firm retains an ownership stake and supports the company as its management works on the business plan.

2. Liquidity and Investment Horizon

PE firms typically commit capital to a company for ten years. They aim to create value while actively shaping the businesses they back. The extended horizon allows for in-depth operational improvements and strategic changes. Individual investors that invest in PE firms can expect their dollars to be working over this period as well.

VC investments have shorter holding periods, that can range from three to seven years. Because VC firms support startups in their early stages, the focus is on nurturing rapid growth and achieving milestones, thus getting investors paid back faster. It’s that trajectory that makes the startup attractive to acquirers or the public markets several years down the road.

3. Regulatory Environment and Investor Qualifications

PE investments are subject to regulatory oversight, but the rules and requirements vary by jurisdiction. Regulations focus on disclosure and transparency. In addition, private equity investments are open to accredited investors, institutional investors, and high net worth individuals. They must meet specific income or net worth thresholds to invest and participate.

VC investments are subject to evolving regulatory landscapes, such as crowdfunding rules. In the last decade crowdfunding platforms and angel investing networks have expanded access to startup investments. As a result, venture capital opportunities may be more accessible to a broader range of investors, including accredited investors and non-accredited individuals.

4. The Investment Process

PE investments carry risks related to business performance, market conditions and the success of implemented strategies. However, they have the potential for substantial returns when successful. When an individual investor is vetting PE firms, it’s important to be aligned with a firm’s investment thesis, understand its due diligence process, and review the firm’s portfolio companies.

On the other hand, VC investments can be more risky than private equity, given the early-stage nature and often untested marketplace of startups. Many startups fail to achieve their goals, which can lead to potential financial losses. However, the potential for significant rewards if a startup succeeds balances the risk.

Conclusion

Venture capital and private equity investments play important roles in fostering economic development and driving innovation. These vehicles provide financial support to startups and growth-stage companies that may otherwise struggle to access capital through traditional means. By injecting funds into these enterprises, VC and PE firms enable them to scale their operations, create jobs and contribute significantly to economic growth. As a result, these companies thrive and investors who saw the potential also increase their wealth.

Whether considering private equity, venture capital or other alternative investment avenues, seek the counsel of financial experts specializing in alternative investments.

Share On LinkedIn More News & Views